Online Company Registration in India – An Overview

one Company Registration of the most highly recommended methods for starting a business in India is to establish a private limited company, which provides its shareholders with limited liability while imposing certain ownership restrictions. When it is LLP, the partners will manage it. On the other hand, a private limited company allows for directors and shareholders to be separate entities.

As your dependable legal advisor, Vakilsearch offers a cost-efficient service for registering your company in India. We handle all legal procedures and ensure compliance with the regulations set forth by the Ministry of Corporate Affairs (MCA).

Register your business outside of India

Expand your business to different countries. Vakilsearch Experts will guide you through the entire process foreign countries include: USA, UK, Dubai, Singapore, Canada, Qatar, Russia, Australia, and +185 countries.

Benefits of Pvt Ltd Company Registration

There are numerous By doing so, you enhance the credibility of your business, which can lead to increased consumer trust. Additionally, company registration can provide various benefits that can help your business to grow and succeed.

- Shield from personal liability and protects from other risks and losses

- Attract more customers

- Procure bank credits and good investments from reliable investors with ease

- Offers liability protection to protect your company’s assets

- Greater capital contribution and greater stability

- Increases the potential to grow big and expand

Checklist for Private Limited Company Registration in India

As defined by the Companies Act, 2013 one must guarantee to meet the checklist requirements without fail for Private Limited Company Registration in India.

Two Directors:

A private limited company must have at least two directors, with a maximum of fifteen. A minimum of one of the company’s directors must be a resident of India.

Unique Name

The name of your pvt ltd company must be unique. The suggested name should not match with any existing companies or trademarks in India.

Minimum Capital Contribution:

There is no minimum capital amount for a Pvt Ltd company. A Pvt limited company should have an of at least ₹1 lakh.

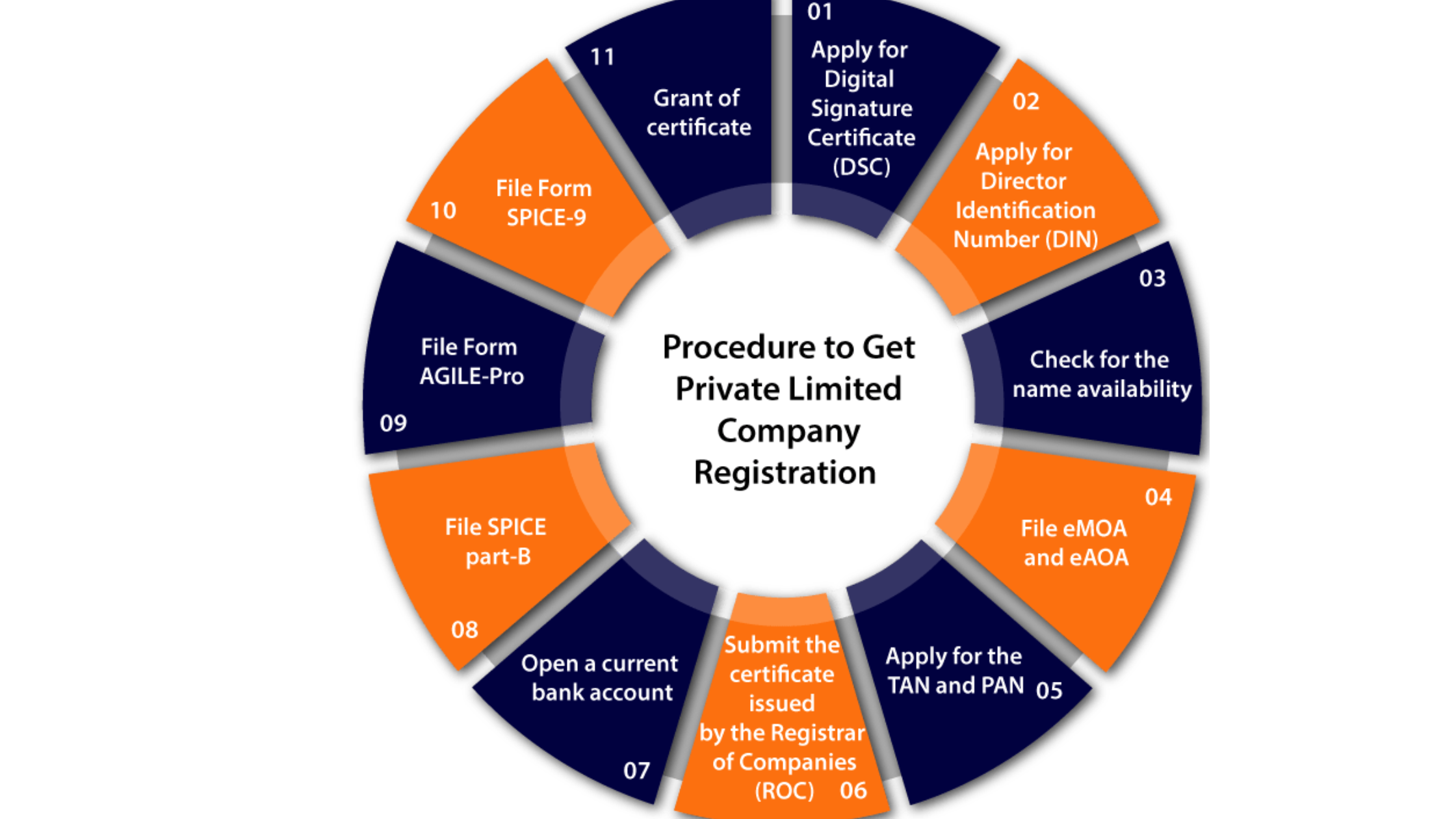

Steps For Company Registration in India

Startups in India can gain an edge over non-registered competitors by registering their companies. While the process of registration is getting complicated and involves numerous compliance requirements, need not worry as Vakilsearch is here to assist you every step of the way. Our team of professionals can provide comprehensive support for Pvt company registration.

Step 1: RUN Name Approval

The first step of company registration involves the registration of your desired name. To reserve a name for your company, you must first submit a request for name approval to the Ministry of Corporate Affairs (MCA). You may include one or two potential names, along with a description of your business objectives, in your application for name approval. If your first choice is not approved, you may submit one or two additional names for consideration. Typically, the MCA approves name requests within five business days. Our team of experts can help you choose the ideal name for your company and guide you through the government registration process.

Step 2: Directors’ Digital Signature Certificate (DSC)

The MCA in India does not recognize traditional signatures. Instead, all filings with the MCA must include a digital signature certified by an Indian certification authority. Thus, it is mandatory for directors to have digital signatures prior to the company’s incorporation.

Vakilsearch will obtain a (DSC) for the directors through a recognized certification entity. To obtain a digital signature, directors must provide a copy of their identification documents and successfully complete a video KYC process. If a director is a foreign national, the nearest embassy should apostille their passport and other documents for company registration.

Step 3: Submitting the Company Incorporation Application

After obtaining the necessary digital signatures, submit the incorporation application in the SPICe form along with all relevant attachments to the MCA. The application for incorporation includes the company’s Memorandum of Association (MOA) and Articles of Association (AOA). If the MCA deems the incorporation application to be complete and acceptable, the company can get the Incorporation certificate and PAN. Typically, the MCA approves all incorporation applications within five business days.

Private Limited Company Registration Compliances

After the process of company registration in India, it is necessary to adhere to various compliance regulations in order to avoid potential fines and legal repercussions. Some of the key post-registration requirements include:

Auditor Appointment: Within 30 days of incorporation, every Indian company must appoint a practicing, certified, and registered (CA).

Director DIN KYC: Every year, individuals who possess a Director Identification Number (DIN) should undergo a DIN KYC process. During the company incorporation process, the company can get the DIN. This helps to verify the phone number and email address on file with the MCA.

Commencement of Business: The shareholders of the company must deposit the subscription amount specified in the MOA within 180 days of incorporation, and the company must create a bank current account. Therefore, to receive a business incorporation certificate, the shareholders of a company established with a paid-up capital of ₹1 lakh must deposit ₹1 lakh into the company’s bank account. They should also file a copy of the bank statement with the MCA.

MCA Annual Filings: Every financial year, the MCA must get a copy of the financial statements from each company registered in India. A corporation that incorporates between January and March may elect to include the first MCA annual return in the annual filing for the following fiscal year. Forms MGT-7 and AOC-4 are the components of the MCA yearly return. The Directors and a working professional must digitally sign both of these documents.

Requirements to Start a Private Limited Company

Before incorporating a firm, it must meet a specific set of conditions. The following are such conditions:

1. Directors and Members

As mentioned earlier, at least two directors and no more than 200 members are necessary for legal Private Limited Company Registration in India. This is a mandatory requirement as per the Companies Act of 2013. The Directors should honor the following conditions:

- Each director should carry a DIN issued by the MCA

- One of the directors must be an Indian resident, which means they must have spent at least 182 days there in the previous calendar year.

2. The Business’s Name

When selecting a name for a private limited company, there are two factors must be into consideration:

- Name of the principal activity

- Private Limited Company

Comparative List of Different Types of Business Structures in India

| Company Type | Ideal for | Tax advantages | Legal compliances |

|---|---|---|---|

| Limited Liability Partnership | Enterprises that focus on services or require little investment | Advantage on depreciation | Company tax returns to be pointed ROC returns to be filed |

| One Person Company | Sole proprietors peeking to limit their liability | Tax holiday for first 3 years under Startup India Higher advantages on depreciation No tax on compensation distribution | Business recoveries to be filed Limited ROC compliance |

| Private Limited Company | Companies that have a high turnover | Tax holiday for first 3 years under Startup India Higher advantages on depreciation | Business tax returns to be filed ROC returns to be filed An audit is mandatory |

Documents Required for Online Company Registration

The MCA requires proper identity and address proof for private limited company registration in India. The following documents are the requirements for registering a company in India:

Identity and Address Proof

- Scanned copy of PAN card or passport (foreign nationals & NRIs)

- Scanned copy of voter ID/passport/driving license

- Scanned copy of the latest bank statement/telephone or mobile bill/electricity or gas bill

- Scanned passport-sized photograph specimen signature (blank document with signature [directors only)

Registered Office Proof

- Scanned copy of the latest bank statement/telephone or mobile bill/electricity or gas bill

- Scanned copy of the notarised rental agreement in English

- Scanned copy of the no-objection certificate from the property owner

- Scanned copy of sale deed/property deed in English (in case of owned property)

Note: Your registered office need not be a commercial space; it can be your residence too.

Reasons to Consider Vakilsearch for Private Limited Company Registration

Vakilsearch offers a completely online private limited company registration process, allowing you to register your entity without leaving the comfort of your home. Our experts can complete the entire incorporation process within 14 days.

Vakilsearch company registration package includes:

- DIN and DSC for two Directors

- Drafting of MoA & AoA

- Registration fees and stamp duty

- Company incorporation certificate

- Company PAN and TAN

- Zero balance current account – Powered by DBS bank

By following these steps, you can begin the process of forming your own private limited company. It is advisable to seek advice from professionals to make informed decisions and ensure seamless growth.

The Glossary

Amendment

In addition to, deletion from, or a change of existing provisions of the articles of incorporation of a domestic corporation.

Board of Directors

The governing body of a corporation is elected by shareholders. The directors are responsible for selecting the officers and the supervision and general control of the corporation.

Certificate of Incorporation

The title of the document is filed in many states to create a corporation. Also known as the articles of incorporation.

DSC

The DSC (Digital Signature Certificate) is an instrument issued by certifying authorities by which you can sign electronic documents. As all documents needed are electronic.

DIN

Director Identification Number

Dissolution

The statutory procedure that terminates the existence of a domestic corporation.

Incorporation

The act of creating or organizing a corporation under the laws of a specific jurisdiction.

FAQs on Private Limited (Pvt Ltd) Company Registration Online In India

What are the rules for picking a name for a private limited company?

How long will take for setting up a private limited company in India?

Do I need to be physically present during this process?

What documents are required to complete the process?

Does a private limited company have continuous existence?

Is it necessary to have a company’s books audited?

What are the Articles of Association (AOA) and Memorandum of Association (MOA)?

Are two directors necessary for the registration of a company?

What is the minimum capital needed to do company incorporation?

Can the director of a private limited company be a salaried

Company Formation in India

Process of Company Incorporation

The process of Company Formation in India proves to be a chore if you lack the best consultants on your team. At Brooks Consulting, we invest the necessary time and effort to understand what your needs are. Our specialized team of corporate economic advisors, chartered accountants, tax consultants is fully equipped to aid you not just with the company registration in Delhi and but also with a wide array of financial and accounting services. This will ensure both a smooth start and hassle-free functioning for your company. Your business will benefit from our experience in online accounting, corporate finance issues, and matters related to foreign investments along with much more.

Registering a Private Limited Company

As defined by the Companies Act 2013, we must guarantee that the checklist requirements are met.

Two Directors:

A private limited company must have at least two directors, with a maximum of fifteen. A minimum of one of the company’s directors must be a resident of India.

Unique Name:

The name of your business must be unique. The suggested name should not match with any existing companies or trademarks in India.

Minimum Capital Contribution:

There is no minimum capital amount for a company. A company should have an authorized capital of at least ₹1 lakh.

Registered Office:

The registered office of a company does not have to be a commercial space. Even a rented home can be the registered office, so long as a NOC is obtained from the landlord.

Documents Required For Pvt Company Registration

The registrar of companies (RoC) across India expects applicants to follow a few naming guidelines. Some of them are subjective, which means that approval can depend on the opinion of the officer handling your application. However, the more closely you follow the rules listed below, the better your chances of approval. First, however, do ensure that your name is available.

What is a Private Limited Company?

A private limited company is a company privately held for small businesses. This type of business entity limits owner liability to their shareholdings, and the number of shareholders to 200, and restricts shareholders from publicly trading shares.

What are the advantages of Private Limited Company Registration in India?

1. Limited risk to personal assets – The shareholders of a private limited company have limited liability. This means that as a shareholder you will be liable to pay for the company’s liability only to the extent of the contribution made by you. The shareholders do not have any personal liability and hence need not pay for the company’s liability out of their own assets.

2. Legal Entity – A PLC has a separate legal entity different from you. This means that the Company is responsible for the management of its assets and liabilities, debtors, and creditors. You will not be held responsible for the losses of the company. So, the creditors cannot proceed against you to recover the money.

3. Raising Capital – Even though registering a PLC comes with compliance requirements, it is preferred by entrepreneurs as it helps them raise funds through equity, expand, and at the same time limit their liability.

Different forms of company registration

Digital signatures are required to file the forms for company formation. The registration process is completely online and the forms require a digital signature. DSC is mandatory for all subscribers and witnesses in the Memorandum of Association (MOA) and Articles of Association (AOA).

You must obtain digital signature certificates from government-recognized certifying authorities. The list of such certified authorities can be accessed here. Or you can get your DSC online in just two days from here. The cost of obtaining a DSC varies depending upon the certifying authority. You must obtain the class 3 category of DSC.

How to Register Private Limited Company

Looking to register your company as a private limited company? Registering your company as a private limited company is difficult as the procedure is complicated and involves many compliances. Do not fear as our experts can help you in every step of the private limited company registration. Instead of reading through the entire registration process, you can avail our expert service.

Documents required for filing SPICe+ (INC-32)

The following documents must be filed with SPICe (INC-32) for a private limited company registration:

A. Where the director and subscriber are Indian Nationals

- An Affidavit on a Stamp Paper is to be given by all the subscribers of the Company to state their willingness to become the shareholders of the Company

- Proof of office address – Rental Agreement or Ownership Deed such as Sale Deed

- Copies of utility bills such as electricity bills, water bills, or gas bills not older than two months

- Copies of utility bills that are not older than two months

- Copy of approval in case the proposed name of the company contains any word(s) or expression(s) that require approval from the central government

How ClearTax Helps in Private Limited Company Registration?

With ClearTax, you can establish your private limited company seamlessly. You can register your Private Limited Company in just 4 simple steps:

Step 1: Purchase the Plan

Purchase ours. You can even chat with our experts by entering your email, and phone number and requesting a callback. Our experts will contact you and clear all your queries.

Step 2: Upload the Documents on our Website

Upload the below-mentioned documents on our website to incorporate your company:

- Passport-size photos of directors

- Address proof of directors

- Photo ID proof of directors

- Specimen signature

- Self-declaration about your directorship in other companies

- Rent agreement of your registered office

- No objection certificate from the owner of the property of the property

- Aadhaar card

- PAN card

The company registration from ClearTax is completely online and thus, you can save time and money as you need not have to visit our office.

What is the Cost involved in Private Limited (Pvt Ltd) Company Registration?

The following are the government fees required for registration:

| Plan amount (includes the below-mentioned fees) | ₹ 9999* |

| DSC | ₹ 2000 |

| DIN | ₹ 1000 |

| Professional Fees | ₹ 3799 |

| Stamp Duty (approx) | ₹ 2000 |

| Notary Fees | ₹ 500 |

| Govt Fees (RUN, PAN, TAN) | ₹ 1200 |

| Goods and Services Tax @ 18% | ₹ 684 |

What is the Time required to register a Private Limited company?

The whole process including approval of DIN, Name, and Incorporation takes around 10 working days. However, nowadays registering a Company has become a fast process as all documents are dragged in a single application form with MCA. It is a big step towards e-governance and for businesses who are looking for expansion of operations.